Wealth preservation is a critical topic in financial services, requiring a nuanced understanding of client needs, investment strategies, and risk management. AI-powered training solutions, such as those offered by AI-Humans, are transforming how financial professionals develop the necessary skills to handle wealth preservation conversations. Through immersive, scenario-based learning, AI plays a key role in making these conversations more realistic, practical, and impactful. Here’s how AI enhances wealth preservation training:

1. Realistic Simulations with AI-Powered Virtual Humans

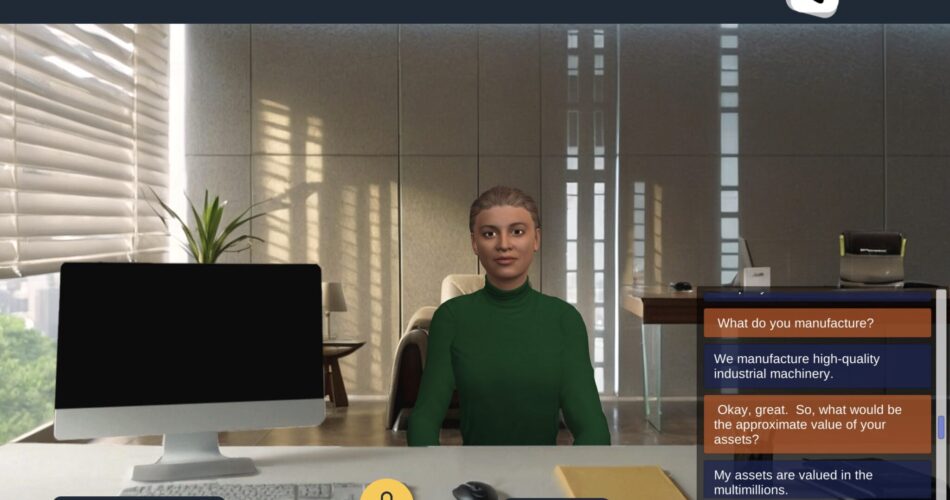

One of the most effective ways AI supports realistic training for wealth preservation conversations is by incorporating AI virtual humans into training scenarios. These virtual characters simulate real-life clients who ask detailed, context-specific questions about wealth preservation, such as managing risk during economic uncertainty or diversifying investment portfolios. Financial professionals can engage with these AI-powered virtual humans in lifelike conversations, allowing them to practice how they would handle difficult client queries, provide advice, and maintain trust.

2. Tailored Scenarios for Industry-Specific Training

AI-driven platforms like AI-Humans enable training coordinators to create customized scenarios specific to wealth management and preservation. These scenarios reflect real-world financial challenges, allowing professionals to navigate complex client conversations about asset protection, investment volatility, and retirement planning. AI tailors each scenario to replicate the high-stakes environment of wealth preservation discussions, making the training relevant and applicable to actual job functions in financial services.

3. Personalized Feedback and Skill Development

During wealth preservation training, AI provides immediate, personalized feedback based on how the financial professional handles the conversation. The system evaluates aspects like communication style, clarity, and the appropriateness of advice, offering suggestions for improvement in real-time. With AI-powered debriefing, professionals can review detailed reports on their performance, including what worked well and what could be improved. This personalized feedback loop helps financial professionals refine their approach and improve the quality of their wealth preservation conversations.

4. Scenario-Based Learning with Adaptive Responses

AI-driven training is designed to adapt to the learner’s performance. In wealth preservation conversations, the virtual client may present different scenarios, such as fluctuating markets or client concerns about tax implications. AI adjusts the complexity of the conversation based on the professional’s responses, ensuring that they are continuously challenged at an appropriate level. This adaptive learning process ensures that financial professionals are better prepared to handle unpredictable client reactions during real wealth preservation discussions.

5. Enhancing Emotional Intelligence and Client Relationships

Wealth preservation discussions often involve emotionally charged topics, such as preparing for retirement, managing family wealth, or safeguarding assets during volatile market conditions. AI-driven training helps professionals develop the emotional intelligence needed to handle these sensitive conversations effectively. By interacting with AI-powered virtual humans, financial professionals can practice empathy, active listening, and conflict resolution, helping them build stronger relationships with their clients. These emotional intelligence skills are critical for navigating the complexities of wealth preservation and maintaining long-term client trust.

6. Practical Application of Wealth Preservation Strategies

Incorporating AI-based eLearning into wealth preservation training allows financial professionals to apply theoretical knowledge in practical, simulated settings. AI-generated scenarios can include topics like estate planning, asset allocation, and risk management, providing professionals with hands-on experience in advising clients on wealth preservation strategies. This practical approach ensures that learners can apply their knowledge effectively in real-world conversations with clients, leading to better financial outcomes.

7. Scalability and Consistency in Training

AI-driven training platforms, such as AI-Humans, offer scalability and consistency, ensuring that wealth preservation training is delivered uniformly across an organization. Whether training a small team or an entire financial firm, AI ensures that all professionals receive the same high-quality, scenario-based training, regardless of location or team size. This consistent approach helps maintain a high standard of client service across the board, especially in critical areas like wealth preservation.

Conclusion

AI plays a transformative role in delivering realistic training for wealth preservation conversations. Through AI virtual humans, AI-based eLearning, and scenario-based learning, financial professionals can practice the skills necessary to navigate complex client interactions and offer tailored advice. By providing personalized feedback, adaptive learning, and emotionally intelligent simulations, AI ensures that professionals are equipped to handle wealth preservation conversations with confidence and expertise. As a result, organizations that leverage AI in their training programs see improved performance, better client relationships, and enhanced financial outcomes.